All Fun & Games

Some of the world’s most popular board games give players the chance to live out professional fantasies. Aspiring property sharks can cheat each other with the classic Monopoly. Would-be Sherlock Holmeses can track down killers with Clue. Armchair generals can settle down to an evening of Risk. But until today there’s never been a game to let aspiring tax planners outwit the Internal Revenue Code. Shouldn’t that be at least as much fun as figuring out it was Colonel Mustard in the Library with the candlestick?

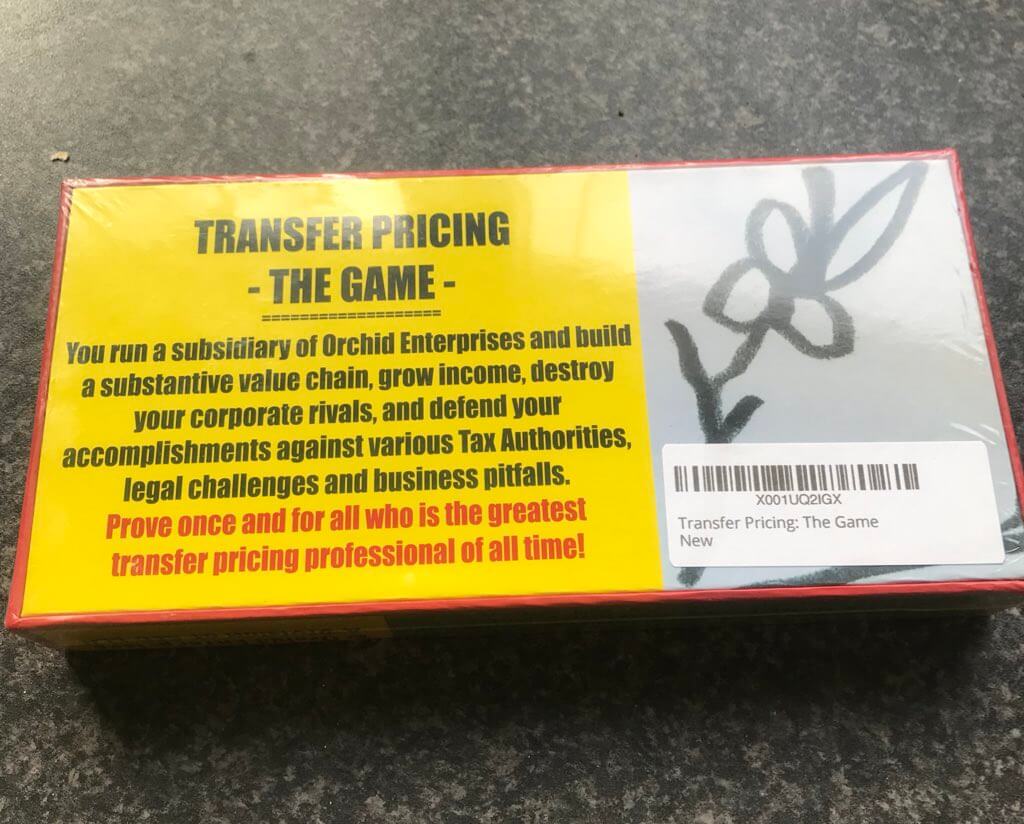

Well, that all changes in the form of a new board game called “Transfer Pricing: The Game.”

Transfer pricing is the process for setting the value of transactions between businesses under common ownership and control. Let’s say Amalgamated Widgets owns a subsidiary that makes parts in, say, Macedonia, then puts them together here in the U.S. How much should the parent pay for the parts? That may sound boring and technical (because, yeah, it is). So what difference does it all make? Let’s say the corporate tax rate in Macedonia is 10% and the rate here is 21%. Naturally, it makes sense to allocate as much of the profit as possible in Macedonia where the rate is lower.

Of course, tax collectors everywhere are on to the game. So you have to be able to show them you’re transferring at an “arm’s length” price — the same price a disinterested buyer would pay from a disinterested seller. The Organisation for Economic Cooperation and Development sets out rules for pricing all sorts of transactions, including tangible items, intellectual property, and even loans.

Now you’re excited to try it yourself! Too bad you don’t own a foreign subsidiary. That’s where “Transfer Pricing: The Game” comes in. The publisher describes it as “the card game that decides who has the most substance. Now available, with an arm’s length price of only $30.” The goal? “You run a subsidiary of Orchid Enterprises and build a substantive value chain, grow income, destroy your corporate rivals, and defend your accomplishments against various Tax Authorities, legal challenges, and business pitfalls. Prove once and for all who is the greatest transfer pricing professional of all time!”

The game is designed for 2-8 players, ages 12 and up. Open the box and you’ll find three sets of cards. “Function” cards represent basic business functions like marketing. “Action” cards drive game play. And “defense” cards provide power you need to defend your actions against various challenges from tax authorities. There’s no board, so technically it’s not a “board game,” but if you’re not comfortable with technicalities, this really isn’t the game for you.

The contest starts when the first player draws an action card and follows the directions (like “audit an opponent”). Once you complete them, you’ll draw another function card and trade it for one of your existing function cards or discard it. To finish a turn, draw a defense card and attach it to a function card or hold it for future play. Look, who are we kidding? The whole thing sounds about as much fun as a group project for an MBA class. Maybe that’s why it recently ranked just #178,162 in Amazon’s “Toys & Games” category.

Here’s all you really need to know. Overpaying your tax is no fun, and tax planning isn’t a game. So call us when you’re ready to play, and get a serious plan to pay less. Then pass GO and find something fun to do with your savings!