By the Time We Got to Woodstock…

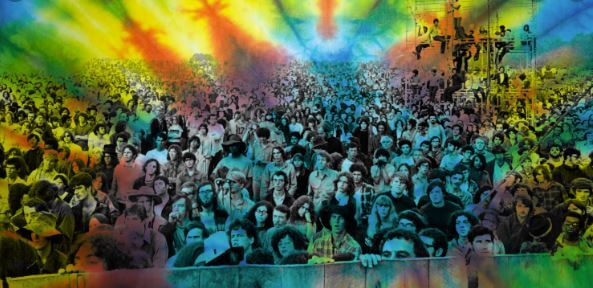

Fifty years ago, a dairy farmer named Max Yasgur thought it would be a rockin’ idea to rent his field to a bunch of kids who wanted to throw a concert. From August 15-17, 400,000 hippies, peaceniks, and plain old music fans converged on the scene. If you’re a 60s fan, Woodstock represents the high point of that era, a giddy celebration of peace, love, and good vibrations. If you’re a hung-up Mr. Normal, you might dismiss it as three days of mud-soaked filth, drugs, and public nudity. And while Woodstock Nation may not have managed to save the world, they managed to leave quite a legacy!

Woodstock Ventures hoped 200,000 fans would pay $6-18 for passes — about $41-124 in today’s dollars. (By contrast, tickets to this year’s Lollapalooza started at $340 and ran to $4,200.) In the end, organizers grossed $1.8 million, suggesting state and local tax collectors shared a groovy $108,000 in sales taxes (3% for the state and 3% for New York City, where most of the tickets were sold).

Sadly for the squares at the IRS, there was nothing left over for them to tax. It wound up costing $3.1 million to rent the farm, book the performers, and charter the helicopters to lift the musicians over the stalled traffic. At the height of the crush, some acts were demanding twice their usual fee to perform — in cash. The Woodstock documentary, edited in part by then-unknown Martin Scorsese, helped start recouping those losses. But it took until Ronald Reagan (!) was president to finally break even — an irony that shouldn’t be lost on counterculture fans.

As the unticketed hordes grew closer, organizers realized there would be no way turn them back, so they declared it a free festival. The crowds turned Yasgur’s farm into the third-largest city in New York, and even created their own sharing-based economy. We’re talking, of course, about the pop-up pharmacies dispensing various psychoactive adventures, including the brown acid that emcee Chip Monck famously warned was “not specifically too good.” Sadly for New York authorities, we suspect none of those unregulated commodity traders bothered filing Forms DTF-17 or ST-101.

Fun fact: members of the Hog Farm commune, led by Hugh Romney (aka “Wavy Gravy”) were running a free kitchen on the premises. On Saturday morning, they served “breakfast in bed for 400,000 people” and introduced the hippies to a brand-new food called “granola” [gru-noh luh]. This has nothing to do with taxes, but it’ll impress your friends when the topic of Woodstock comes up over the next few days.

Today, Yasgur’s farm is still finessing taxes like Jimi Hendrix shredded the national anthem. That’s because it’s owned by the nonprofit Bethel Woods Center for the Arts, home to a 15,000-seat amphitheater and museum. Local sales tax collectors still take a piece of ticketing and merchandise. But income tax collectors are no-shows (just like concert no-shows Joni Mitchell, the Doors, and others). And while property taxes in Sullivan County generally range from $25-65 per thousand of assessed value, the center’s nonprofit status takes 800 acres off the property tax rolls.

Today’s music festivals, like Coachella and Burning Man, all try to recapture a bit of that Woodstock magic. Sadly for the fans, the acts are a bit more corporate, the facilities are a bit cleaner, and even the drugs are a bit tamer. (Legal marijuana . . . where’s the rebellion in that?) So for this week we’ll leave you with a pipeful of gentle hippie sentiments, and hope you enjoy the rest of your summer. Next month after Labor Day, official tax planning season starts, so get ready to save!